Furlough Calculation Example Variable Pay

Multiply by 9 the number of furlough days in March Multiply by 80 which is 55742. We have a seasonal business with employees paid weekly on hours worked.

Https Elliswhittam Com Covid 19 Partnerships Wp Content Uploads 2020 06 Job Retention Scheme Faq Pdf

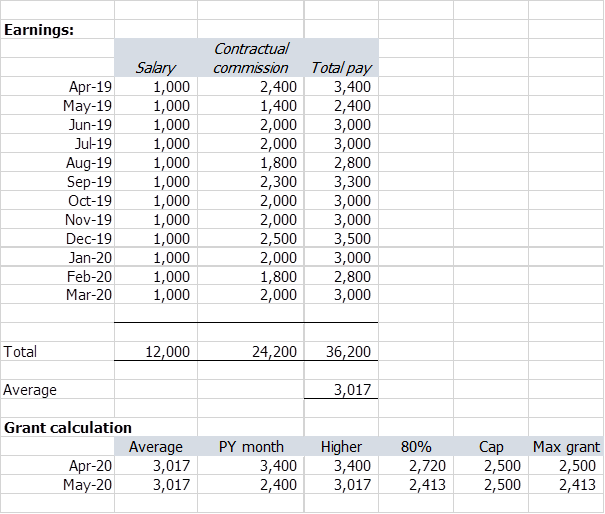

I understand that for someone who is on variable pay their furlough has to be calculated by looking at same months wages from previous year or average monthly wages for 1920 tax year and we claim 80 of whichever is highest.

Furlough calculation example variable pay. Start with the amount of minimum furlough pay whether Flexible or Fully Furlough. If they have variable hours or pay their holiday pay is calculated as an average of the previous 52-weeks of remuneration excluding weeks in which there was no remuneration. Where a worker has regular hours and pay their holiday pay would be calculated based on these hours.

Staff have been continuously furloughed. Multiply by the number of furlough days in the pay period or partial pay period youre claiming for. How are these rules for variable pay and variable hour employees changing.

Multiply by the number of furlough days 29. Furloughed workers An employer should not automatically pay a worker on holiday the rate of pay that they are receiving while on furlough unless the employer has agreed to not reduce the workers pay while on furlough. The average amount payable in the 201920 tax year before any period of furlough began.

Multiply by 14 the number of furlough days in the pay period or partial pay period the employer is claiming for. If the employee has been employed for 12 months at 28 February 2020 there are two options and the higher of the two can be used as a basis for the claim. If they have variable hours or pay their holiday pay is calculated as an average of the.

Read guidance on how to work out 80 of. For staff who were working back in March 2020 their furlough was worked out. Accordingly I have worked out the average pay in 2019-20 excluding week 52 where we were.

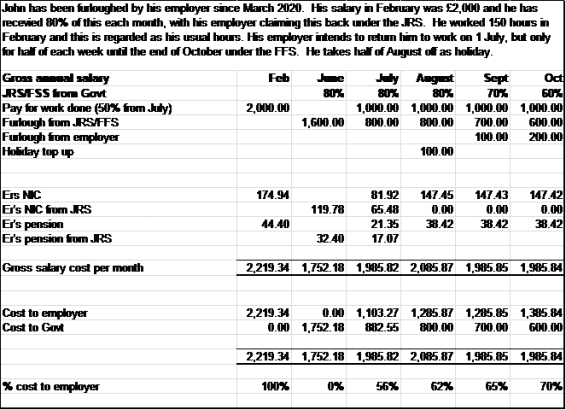

We then compare that to the pro-rated cap on earnings in July of 2500167 x. Examples have been added for working out how much of the minimum furlough pay you can claim for July 2021 and for August 2021. 114840 x 80 91872 furlough pay.

If your employee has not been paid for a full pay period up to 19 March 2020 youll need to work out what their usual wages are and then calculate 80. Start with the hours your employee was contracted for at the end of the last pay. Fixed and variable calculation examples a Fixed number of hours whose pay is not dependent on the number of hours worked For employees contracted to work a fixed number of hours or whos pay does not vary you need to calculate the usual hours for each pay period or part of a pay period that falls within the claim period.

Do I roll forward on the month for the previous year for each pay run. Worker started work for B Ltd in 1997 and is paid a regular monthly salary on the last day of each month. I have for now assumed that for monthly I can read weekly and apply the same logic.

The proportion of pay that relates to furloughed hours is 226962167 x 845 114840. To calculate the number of usual hours for each pay period or partial pay period. Multiply by the number of furlough days in the pay period Multiply by 80 The following example is provided.

Depending on which month youre claiming for multiply by. Furlough and variable weekly pay. The employer pays 80 of Toms usual pay for those furloughed hours.

For those on variable pay an average over 12 weeks was already the calculation and furlough was also affecting the amount received. 15 July 2021. Multiply by 80 2320.

Many employees are paid hourly and earnings can vary so the calculation used for salaried workers cant really be used. Multiply by 80 this is 48172. All the Job Retention Scheme language refers to monthly pay.

One example has been added to the full examples. All staff are on variable pay. Divide by the number of days in the pay period the employer is claiming for which is 30 days in the June 2021 pay period.

For CJRS claim periods in March and April reference salary for an affected variable rate employee will now be calculated as the higher of. Staff who had been on furlough particularly flexible furlough were being effectively penalised in the amount of redundancy pay and potentially notice pay they were getting. Divide by the total number of days in the pay period youre calculating for.

This will then leave the amount to be included on the CJRS Wage claim submission. If your employee has not been paid for a full pay period up to 19 March 2020. When calculation furlough pay for employees on variable pay - who have been employed for over 12 month I understand that I use the higher of either their 12 month average OR the same month from the previous year.

Https Iris12pay Co Uk App Uploads 2020 11 12pay Covid 19 Furloughed Employee Job Retention Scheme Payroll Processing Changes Inc Furlough Extension Pdf

Coronavirus Job Retention Scheme Updated Guidance Johnston Carmichael

Payroll Software Brightpay Uk Blog

Https Www Condie Co Uk Covid 19 Coronavirus Job Retention Scheme 2 1 July 31 October 2020

How To Calculate Your Employees Flexible Furlough Hours Mitrefinch

Https Elliswhittam Com Covid 19 Partnerships Wp Content Uploads 2020 06 Flexible Furlough Guidance Pdf

Http Www Chadwicklawrence Co Uk Wp Content Uploads 2020 11 Coronavirus Job Retention Scheme Extended E2 80 93 05 11 20 Pdf

Https Iris12pay Co Uk App Uploads 2020 11 12pay Covid 19 Furloughed Employee Job Retention Scheme Payroll Processing Changes Inc Furlough Extension Pdf

Https Iris12pay Co Uk App Uploads 2020 11 12pay Covid 19 Furloughed Employee Job Retention Scheme Payroll Processing Changes Inc Furlough Extension Pdf

Flexible Furlough Scheme Albert Goodman Chartered Accountants

Https Elliswhittam Com Covid 19 Partnerships Wp Content Uploads 2020 06 Job Retention Scheme Faq Pdf

Https Www Eca Co Uk Cmspages Getfile Aspx Guid 820bb725 5e5b 4703 88d6 Fc26c4d707cf

Https Elliswhittam Com Covid 19 Partnerships Wp Content Uploads 2020 06 Flexible Furlough Guidance Pdf

Https Www Colas Co Uk Media 3372 Covid 19 Information And Advice Updated 010720 Pdf

Https Iris12pay Co Uk App Uploads 2020 11 12pay Covid 19 Furloughed Employee Job Retention Scheme Payroll Processing Changes Inc Furlough Extension Pdf

Payroll Software Brightpay Uk Blog

Https Www Condie Co Uk Covid 19 Coronavirus Job Retention Scheme 2 1 July 31 October 2020

Post a Comment for "Furlough Calculation Example Variable Pay"